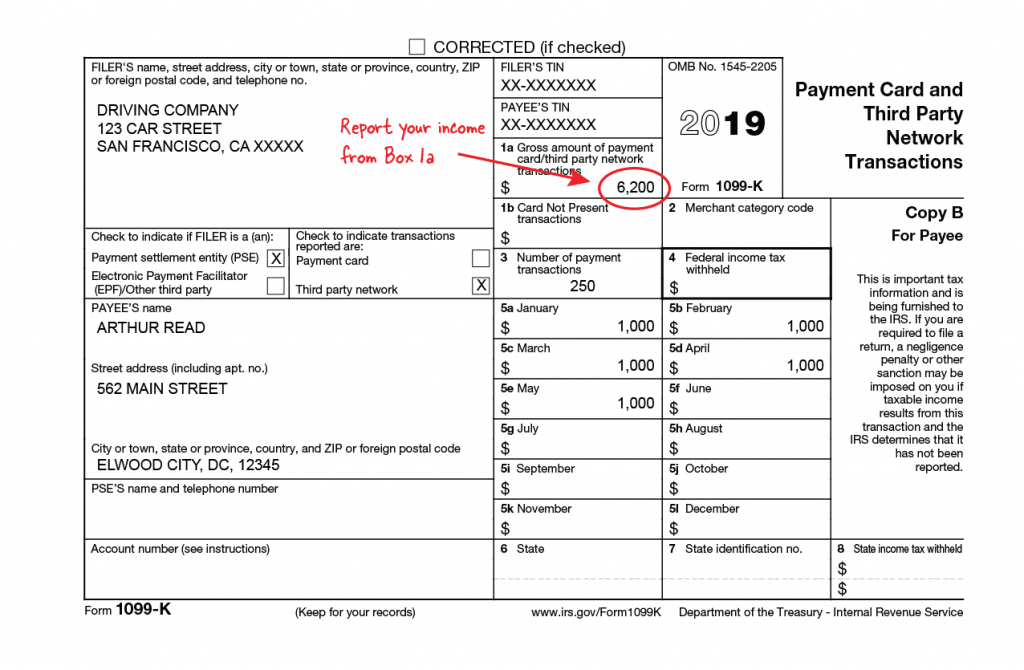

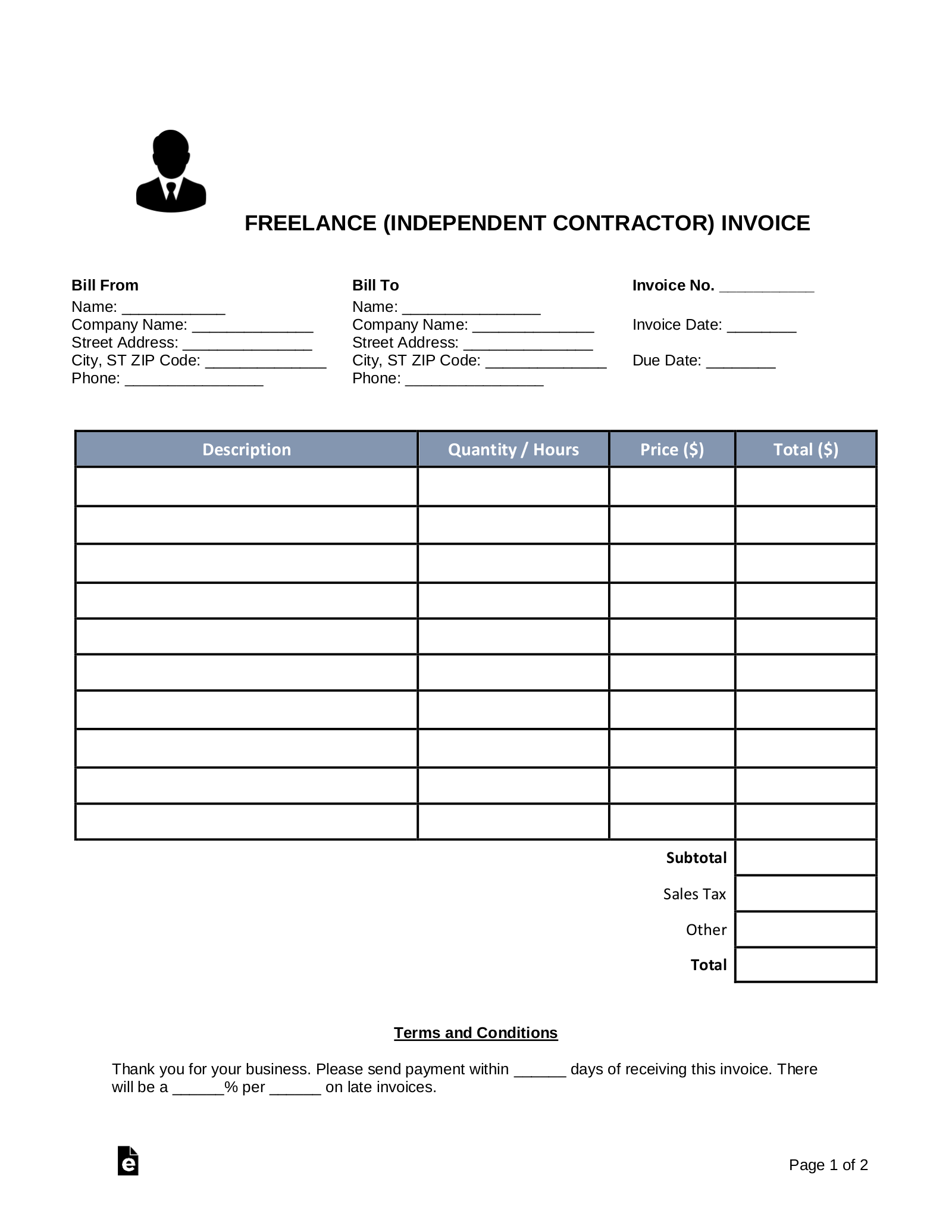

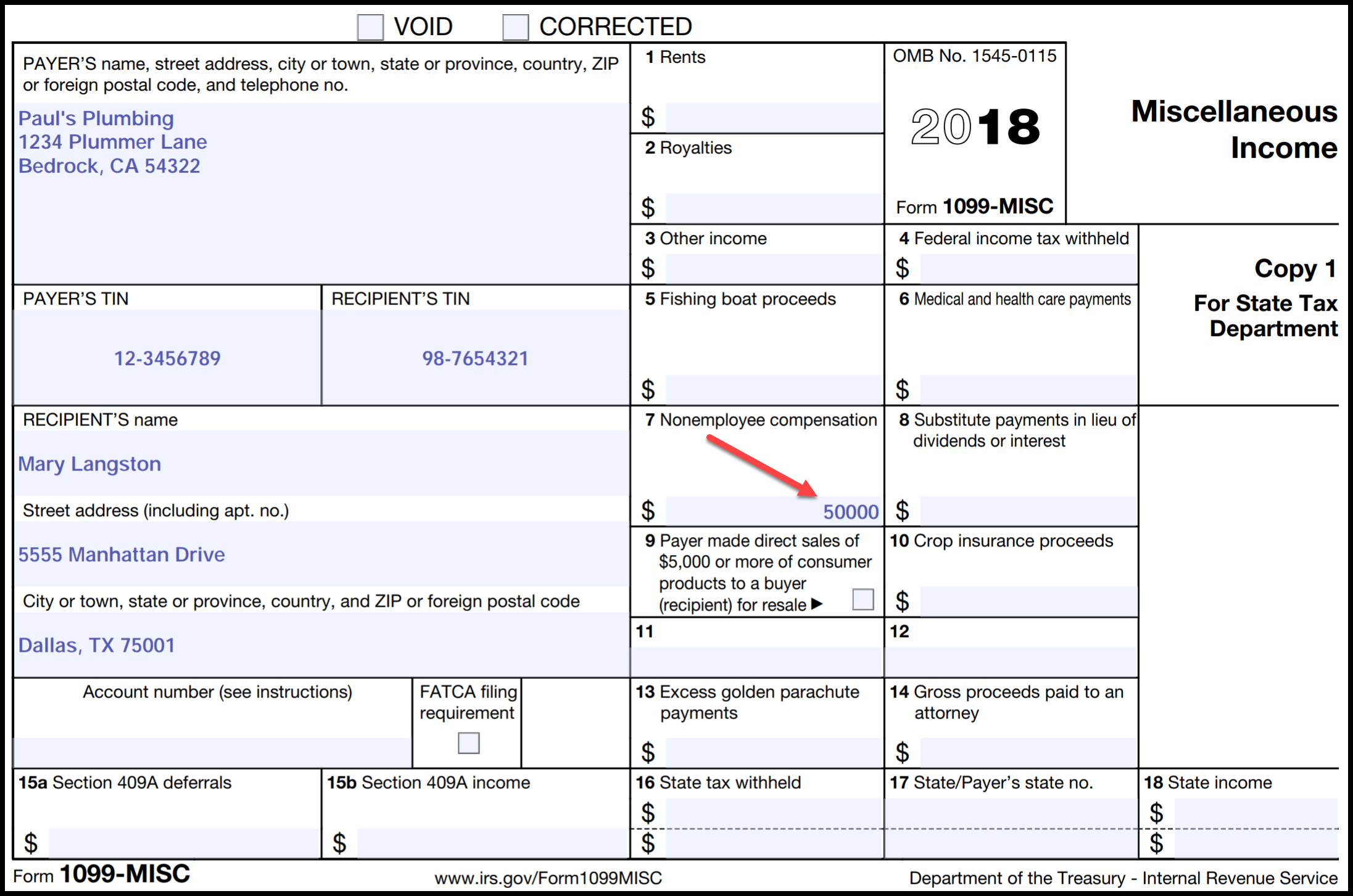

Download the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of the year ifDetails Form 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or tradeThere is no requirement for US companies to file an IRS 1099 Form to pay a foreign contractor But as noted above, the company should require the contractor file IRS Form W8BEN, which formally certifies the worker's foreign status

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

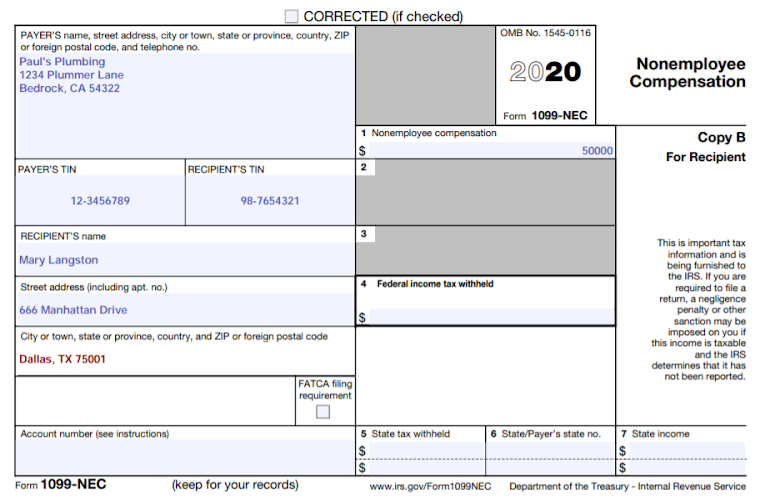

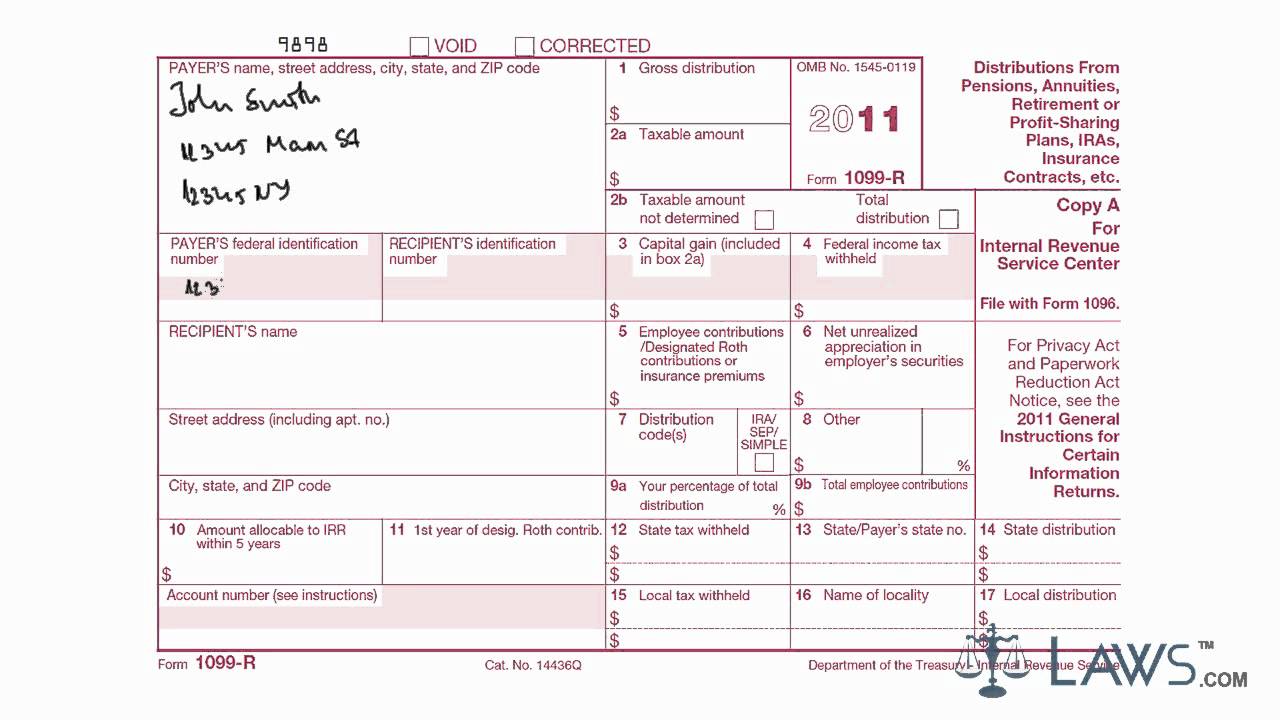

Sample independent contractor 1099 form

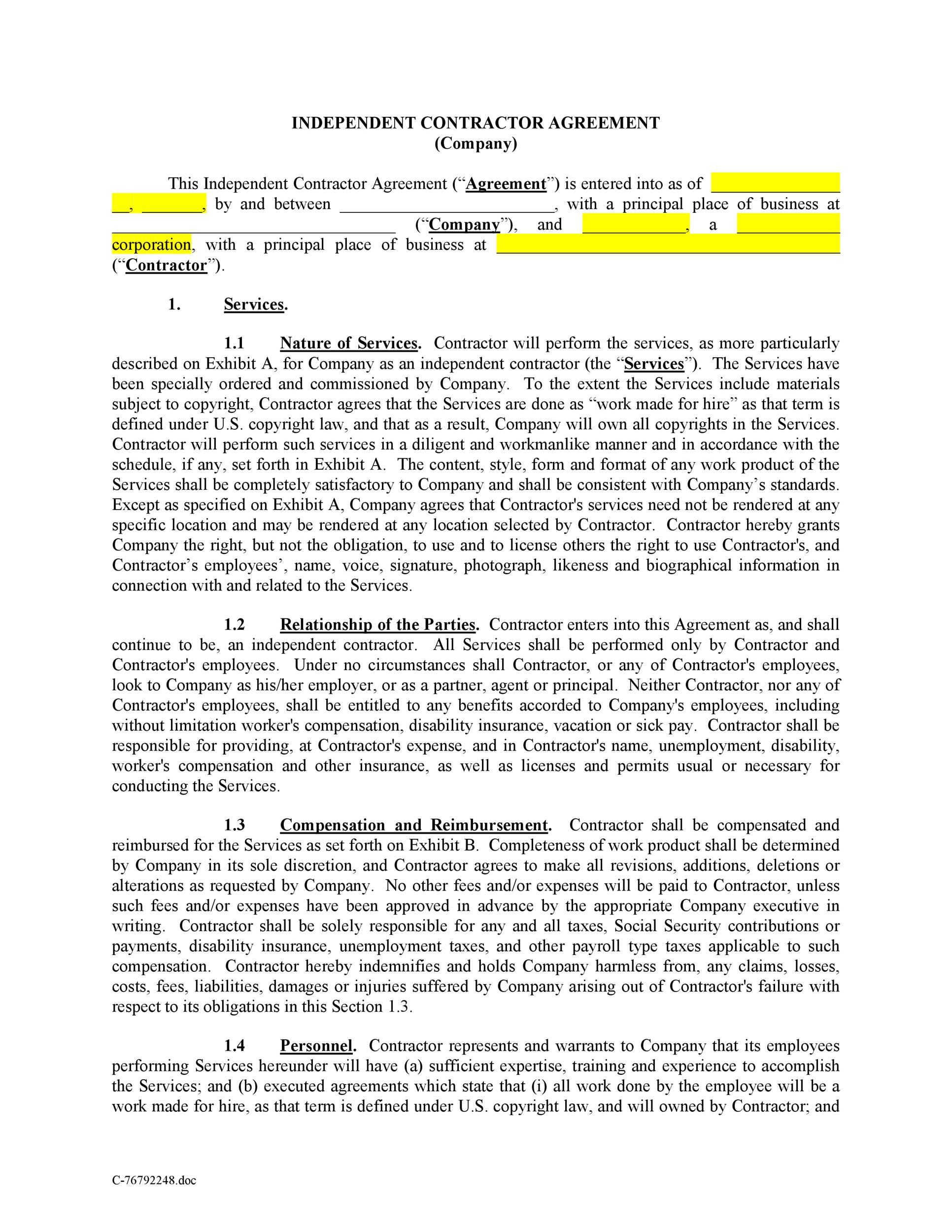

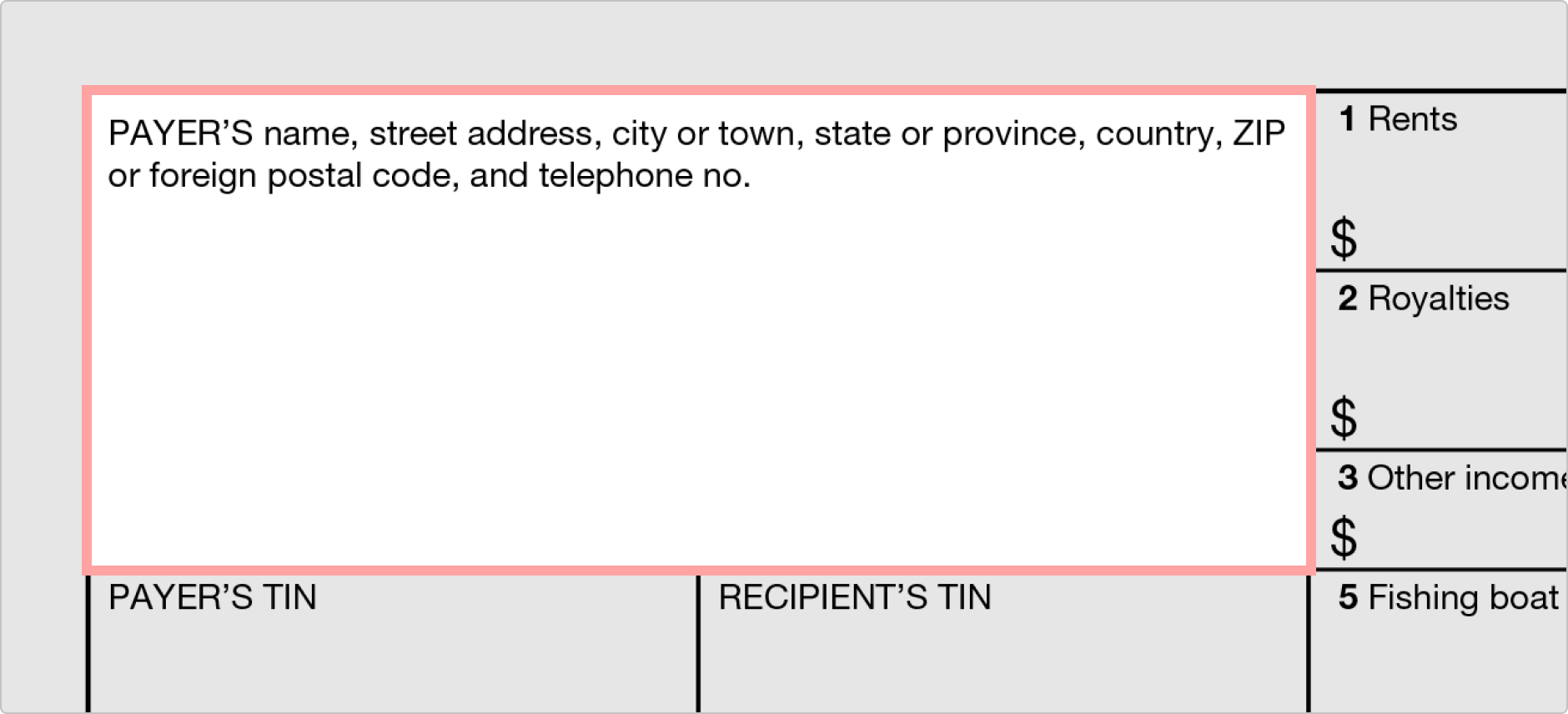

Sample independent contractor 1099 form- Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC)If an incomeverification letter isn't available, there are several other options independent contractors can use to verify their income Contracts and agreements An independent contractor will typically coordinate a contract or agreement with a new client in order to document the terms of their working arrangement

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

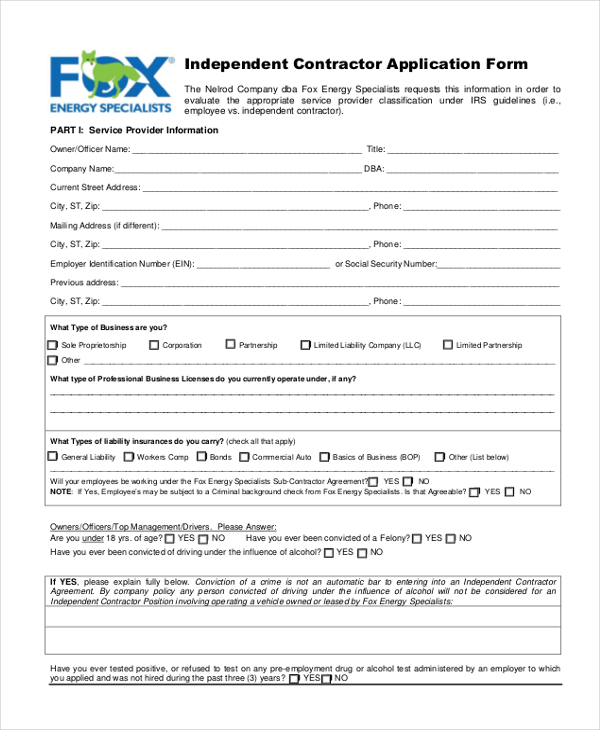

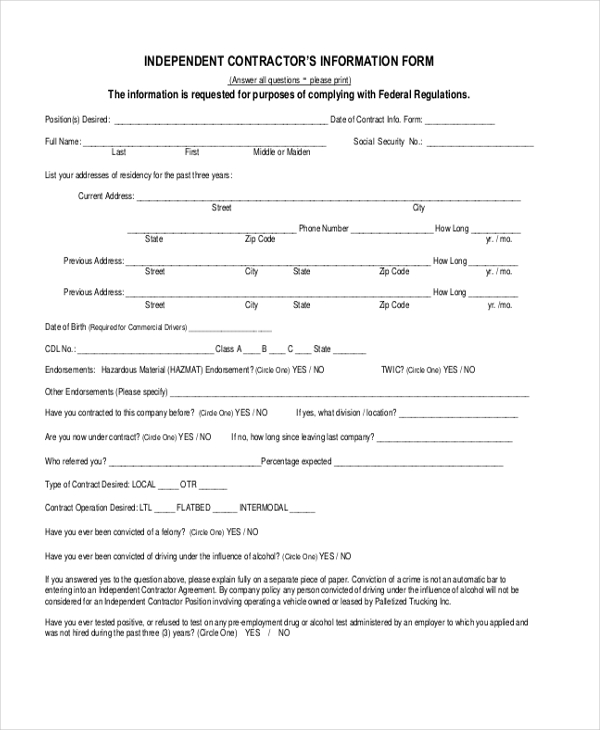

INDEPENDENT CONTRACTOR ACKNOWLEDGEMENT FORM The Independent Contractor handbook describes important information about Market Street Talent's policies for Independent Contractors on assignment at Market Street Talent's Clients, and I understand that I should consult Jennifer Gray of Market Street Talent regarding any Employees who only get commissions are called 1099ers due to the 1099MISC form that they receive every year This is different from the W2 forms that salaried and hourly employees get What are Independent 1099 Sales Representatives?You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files

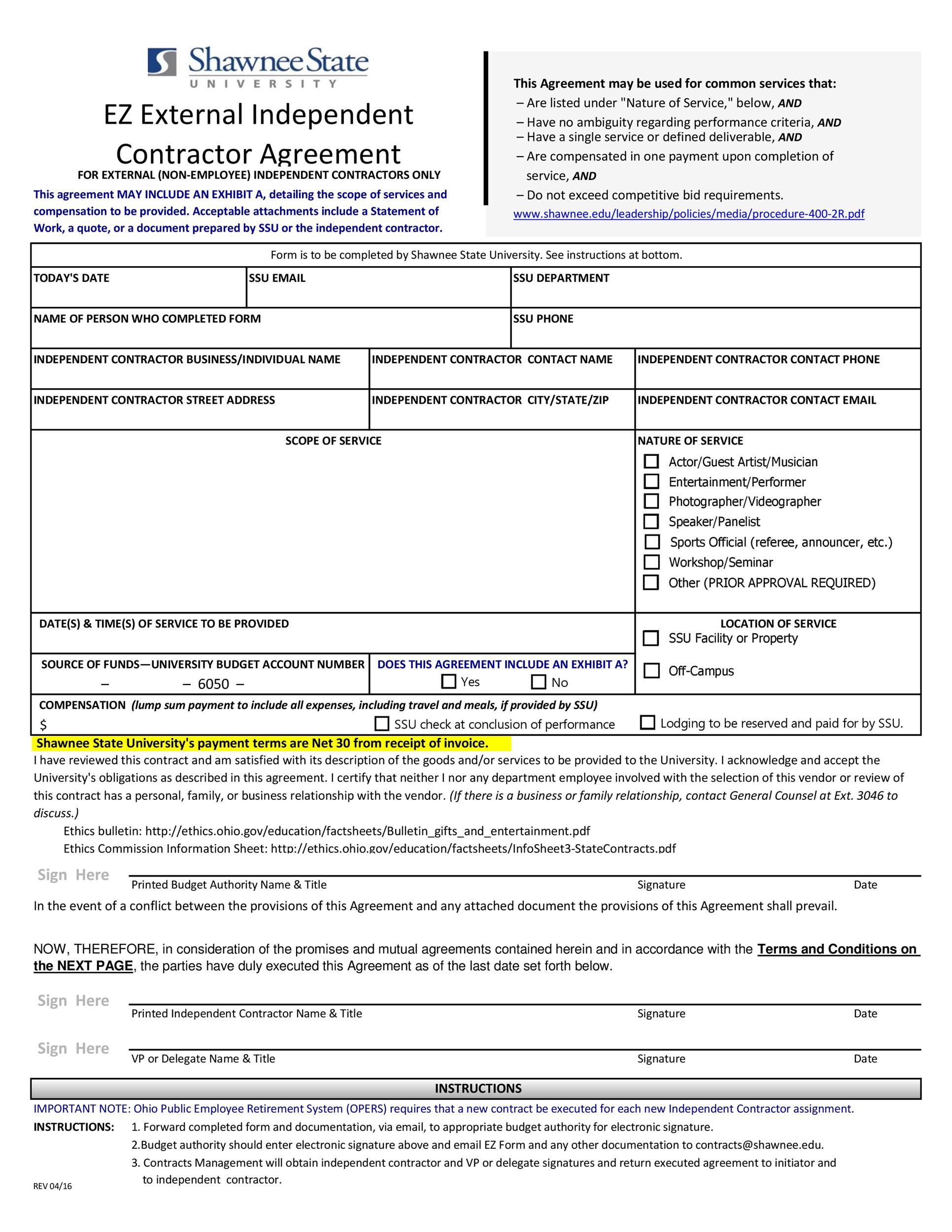

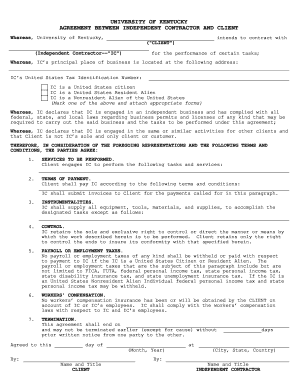

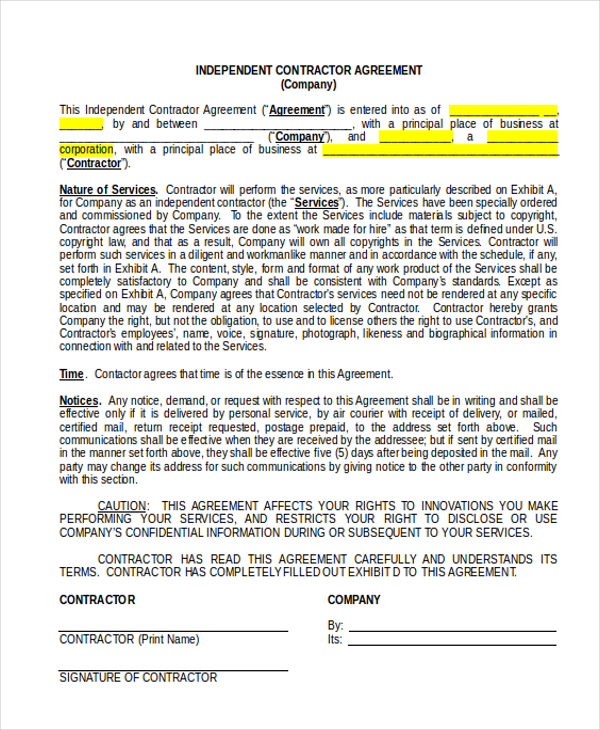

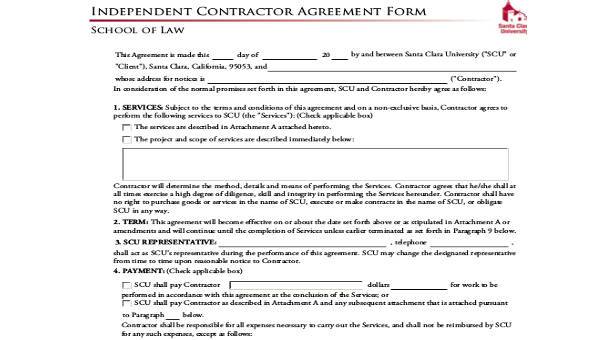

A legal contractor is someone who does the following Controls when and how customers are seenClient will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employeesAn independent contractor form can be used by the contractor himself or by an organization that intends to hire the services of a contractor A contractor can use the form to register himself in the government roster, to send a proposal to the client or

You have to file IRS Form 1099 to report taxes on payments to independent contractors This needs to be done for every independent contractor to whom you've paid at least $600 for services, and can be done easily with a Form 1099MISC builder Sample Independent Contractor Agreement Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting themHow To Fill Out Sample Independent Contractor Agreement Form?

1

Independent Contractor 1099 Invoice Templates Pdf Word Excel

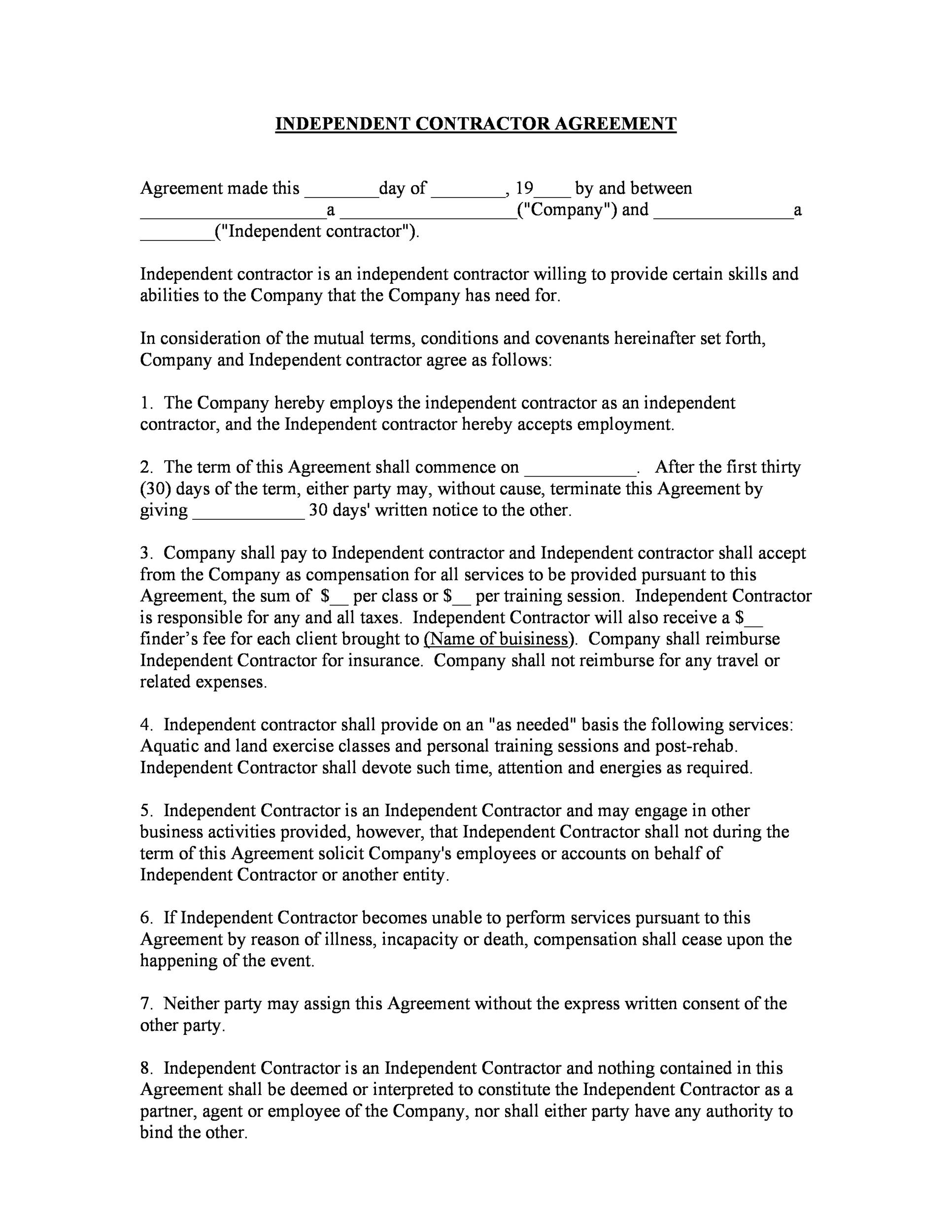

Independent Contractor is an Independent Contractor and nothing contained in this Agreement shall be deemed or interpreted to constitute the Independent Contractor as a partner, agent or employee of the Company, nor shall either party have any authority to bind the other 9 It is agreed between the parties that there are no other agreements orForm 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or tradeIRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the work

Dealing With Fraudulent Or Incorrect 1099 Robinson Henry P C

How To File 1099 Misc For Independent Contractor Checkmark Blog

INDEPENDENT CONTRACTOR AGREEMENT It is understood and agreed that HWS shall provide Contractor with a Form 1099 in accordance with applicable federal, state, and local income tax laws To the extent either Party is required by law to demonstrate compliance with any1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Independent Contractor The relationship between Contractor and Eastmark is that of an in tangible form shall be returned immediately to the disclosing party Following the termination ofAn independent contractor is not considered an employee for Form I9 purposes and does not need to complete Form I9 What are the rules for a 1099 employee?

How To Fill Out A 1099 Misc Form

1099 Misc 14

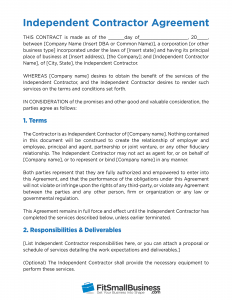

Independent Contractor Agreement Form Template with Sample Free Independent Contractor Agreement Form Download Business Form Template Gallery 5 1099 Employee Contract Template Oiupt 1099 Employee Agreement form Employee Contract for 1099 1099 Employee Contract Template Independent ContractorThe most important document you will need to hire freelancers and independent contractors is an Independent Contractor Agreement This outlines the terms of a deal between a client and contractor and makes the agreed terms legally binding It will also be necessary to have an IRS form W9 available when you begin the process of hiring a contractor_____ ("Independent Contractor") Independent Contractor is an independent contractor willing to provide certain skills and abilities to the Employer that the Employer has a demand and need In consideration of the mutual terms, conditions, and covenants hereinafter set forth, Employer and Independent Contractor agree as follows 1 Work

1

Free Independent Contractor Agreement Templates Pdf Word Eforms

Form 1099MISC is out and 1099NEC is in Stay in the IRS' good graces, and avoid fines, by completing the new 1099NEC form on time and correctly DOL proposes new rule to define independentAn independent contractor may need to file a 1099MISC form with the IRS to report freelance earnings A company employing independent contractors, will need to complete a 1099MISC form if payments to individual contractors reach a threshold set by the IRSGet Great Deals at Amazon Here http//amznto/2FLu8NwIRS Order Forms https//bitly/2kkMEkkHow to fill out 1099MISC Form Contract Work Nonemployee Compens

1099 Form Fileunemployment Org

How To Pay Contractors And Freelancers Clockify Blog

Sample independent contractor agreements are available online Using an independent contractor agreement template will save you time over creating an agreement from scratch If you hire an independent contractor, you will be required to fill out a Form 1099NEC if you pay them more than $600 within a year The 1099NEC is needed to reportDo not designate someone as a 1099 Employee if Company provides training on a certain method of job performance5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows (check all that apply)

Form 1099 Misc It S Your Yale

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

For independent contractors, filing taxes is a little more complicated Contractors don't have an employer, so they're responsible for paying taxes and reporting their income 1099 contractors must use form 1040 to report income However, contractors have other formsIndependent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, FICA, or other amounts from its payments to Independent Contractor 9 Obligations of Independent Contractor – Independent Contractor acknowledges and agrees While you may have heard the term "1099 employee," it's a misnomer a 1099 employee technically doesn't exist because employees are classified differently than independent contractors—and it's contractors who use the 1099 form 1099 contractors can often add just the extra burst of talent and speed you're looking for

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

1099 Misc Form Fillable Printable Download Free Instructions

30 SAMPLE Independent Contractor Agreement Forms & Templates in PDF MS Word Rating An independent contractor comes with a varied assortment of perks that fulltime employees cannot provide In addition to saving you from certain expenses and providing flexibility to your staff capacity, there's also the reduced chances of lawsuits in playSLS SAMPLE DOCUMENT 06/21/18 Independent Contractor Agreement Note This document does not reflect or constitute legal advice This is a sample made available by the Organizations and Transactions Clinic at Stanford Law School on the basis set out at nonprofitdocumentslawstanfordedu Your use of this document does not create an attorneyIndependent contractors handle taxes related to social security, medicare etc Employers have to produce a W9 to be completed by the independent contractor You may have to file information returns (form 1099MISC) to report certain types of payments made to independent contractors

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Free Independent Contractor Agreement Free To Print Save Download

No, you do not file a 1099MISC Miscellaneous Income form 1099MISC forms are usually given to independent contractor's from people/companies they have worked for but are not their W2 employee's Note You can deduct your business related expenses, like mileage, costumes, supplies, etc, on your income tax return Even if you received cash, the IRS says allTax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate6 Independent Contractor It is understood that the Representative is an independent contractor, and nothing contained in this Agreement shall be construed as appointing the Representative as an employee of the Company Correspondingly, it is understood that the Representative is solely responsible for the payment of all taxes on commissions paid

Who Are Independent Contractors And How Can I Get 1099s For Free

Uber Tax Forms What You Need To File Shared Economy Tax

25 Little Known 1099 Independent Contractor Deductions Don't sweat getting a form 1099MISC Here we will do a dive deep into tax deductions other than your typical office supplies To shed some light and make itemizations a little less "taxing," Keeper Tax has compiled a quick summary of deductions you might qualify for, and should beYou are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting filesCollect 1099 forms You can order copies of the 1099 forms directly from the IRS, from an online tax/payroll service, at an office supply store or from your accountant You can't just print the sample forms off the internet, though, as the IRS will not accept them Complete a 1099 for each contractor

Form 1099 K Wikipedia

What Is A 1099 Contractor With Pictures

The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)An Independent Contractor Agreement is a written contract that spells out the terms of the working arrangement between a contractor and client, including A description of the services provided Terms and length of the project or service Payment details (including deposits, retainers, and other billing details) You must provide Form 1099NEC to your contractors each year Understanding Form 1099NEC A company must provide a 1099NEC to each contractor who is paid $600 or more in a calendar year Independent contractors must include all payments on a tax return, including payments that total less than $600

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

CONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the otherContractor shall require all employees who perform Services and/or have performed Services hereunder to sign a copy of the form attached hereto as Exhibit C and Contractor shall forward copies of all of such forms to Company within five (5) days of executing the Agreement and/or within five (5) days of assigning a new employee to performSpreadsheet or 1099 Excel Template Spreadsheets are a great way to track both your income and your expenses as an independent contractor To get started, create four columns They should be labeled item, cost, date, and then receipt You can make notes about where the receipt is located (maybe an email folder or a physical file)

50 Free Independent Contractor Agreement Forms Templates

Free Sample Independent Contractor Agreement Download Wise

The independent contractor forms are somewhat similar to contractor proposal forms but while the latter is just about the services to be offered by the contractor the former offers a comprehensive view of the agreement and the T&C to be followed by the company and contractorIn addition to the IRS forms that an independent contractor must file, their clients and employers are required to submit information regarding their transactions as well Any individuals or entities who have paid the independent contractor more than six hundred dollars ($600) within a tax year are required to file Form 1099 which details the Taxpayer ID Numbers for Form 1099NEC You must have a valid tax ID number for a nonemployee before you prepare Form 1099NEC When you hire a nonemployee, you must get a W9 form from them reporting this and other identifying information you'll need to complete Form 1099NEC Document your efforts to obtain a completed W9 form by keeping

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

50 Free Independent Contractor Agreement Forms Templates

1099 Form Independent Contractor Free

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Form Pros

50 Free Independent Contractor Agreement Forms Templates

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

Irs Form 1096 What Is It

Free Independent Contractor Agreement Template What To Avoid

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Independent Contractor Agreement Template Free Pdf Sample Formswift

Independent Contractor Agreement Form California New Independent Contractor Agreement Template 50 New Independent Models Form Ideas

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Understanding The 1099 Misc Tax Form

50 Free Independent Contractor Agreement Forms Templates

How To Fill Out 1099 Misc Form Independent Contractor Work Instructions Example Explained Youtube

50 Free Independent Contractor Agreement Forms Templates

Form 1099 Nec For Nonemployee Compensation H R Block

How To File 1099 Misc For Independent Contractor Checkmark Blog

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

1099 Form Independent Contractor Free

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

What Is The Difference Between A W 2 And 1099 Aps Payroll

1

What Tax Forms Do I Need For An Independent Contractor Legal Io

1099 Misc Instructions And How To File Square

1099 Form Independent Contractor Free

1099 Misc Form Fillable Printable Download Free Instructions

Irs Form 1099 Reporting For Small Business Owners In

Independent Contractor 101 Bastian Accounting For Photographers

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

Irs Form 1099 Reporting For Small Business Owners In

1099 Form 21 Printable Fillable Blank

1099 Misc Form Fillable Printable Download Free Instructions

What Are Irs 1099 Forms

Small Business Tax Preparation For Independent Contractors

Free 9 Sample Independent Contractor Forms In Ms Word Pdf Excel

Independent Contractor 1099 Invoice Templates Pdf Word Excel

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Form Independent Contractor Agreement

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Learn How To Fill The Form 1099 R Miscellaneous Income Youtube

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

Free 9 Sample Independent Contractor Forms In Ms Word Pdf Excel

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Independent Contractor 1099 Invoice Templates Pdf Word Excel

1099 Misc Form Fillable Printable Download Free Instructions

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

Independent Contractor Taxes Guide 21

Independent Contractor 101 Bastian Accounting For Photographers

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Instant Form 1099 Generator Create 1099 Easily Form Pros

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Free Freelance Independent Contractor Invoice Template Word Pdf Eforms

50 Free Independent Contractor Agreement Forms Templates

Your Ultimate Guide To 1099s

Create An Independent Contractor Agreement Download Print Pdf Word

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

Form 1099 Definition

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Gosling Company Certified Public Accountants

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Form Independent Contractor Free

Free Independent Contractor Agreement Pdf Word

Free Florida Independent Contractor Agreement Word Pdf Eforms

50 Free Independent Contractor Agreement Forms Templates

Form 1099 Misc It S Your Yale

1099 Form Irs 18

What Is The Account Number On A 1099 Misc Form Workful

How To File 1099 Misc For Independent Contractor Checkmark Blog

0 件のコメント:

コメントを投稿